nh property tax rates by town 2019

15 15 to 25 25 to 30 30 Click tap or touch any marker on the map below for more detail about that towns tax rates. 236 rows Town Total 2020 Tax Rate Change from 2019.

Real Estate Real Estate Estates Bobvila Com

The following are the reports published for the 2019 Tax Year.

. The Town portion of the tax rate remained constant at 657. The ratio for 2021 is 961 the 2022 ratio has not been established yet by the Department of Revenue. Nh property tax rates by town 2019 Saturday March 12 2022 Edit.

15 15 to 25 25 to 30 30. NH DEPARTMENT OF REVENUE ADMINISTRATION. All banks mortgage rates are different.

Hanover Town Hall PO Box 483 Hanover NH 03755 603 643-0742 Hours. 2019 Ratio 2019 Total Equalized Valuation Including Utilities Railroad Total Property Taxes Assessed War Service Credits Net Tax Commitment 2019 Total Tax Rate Municipality Lyme 942 377098674 9497344. When combining all local county and state property taxes these towns have the highest property tax rates in New Hampshire as of January 1 2022.

Understanding NH Property Taxes. Historical view of rates. City of Dover New Hampshire.

Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only. What are you looking for. Although the Department makes every effort to ensure the accuracy of data and information.

Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year. Its Fast Easy. 2020 NH Property Tax Rates.

Property Tax Year is April 1 to March 31. NH DEPARTMENT OF REVENUE ADMINISTRATION MUNICIPAL AND PROPERTY DIVISION 2019 Tax Rate Calculation City Town Unincorporated Place Acworth Albany. City or Town Tax on a 278000 house see note 1403 687 109 226 2425 1073 336 390 217 2016 1407 499 248 188 2342 2187 1527 276 218 4208 682 243 609 261 1795 1254 1093 464 202 3013 742 274 491 239 1746 1340 990 275 214 2819 1021 586 135 235 1977 1298 391 294 216 2199 -214 -514 513 215 000 775 366 277 205 1623 000 000.

New hampshire department of revenue administration 2019 village tax rates apportioned 007 088 10282019 000 148 131 066 000 1232019 123 493. New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes. State Education Property Tax Warrant.

Apportionment Net Cooperative School 2 Apportionment 1. Benedict officially the County of San Benito is a county located in the Coast Range Mountains of the US. Transfer Station.

New Hampshire Town Property Taxes Acworth 2293 Albany 124 Alexandria 1882 Allenstown 315 Alstead 2325 Alton 1138 Amherst 2131 Andover 2091 Antrim 2607 Ashland 2747. Tax Rate and Ratio History. Hampstead NH 03841 603 329-4100.

Download a Full Property Report with Tax Assessment Values More. Posted on December 15 2020 by December 15 2020 by. Tax Rate History.

2019 Tax Rate Calculation City Town Unincorporated Place Town Appropriation Town Tax. Claremont 4098 Berlin 3654 Gorham 3560 Northumberland 3531 Newport 3300. 2021Town Tax Rate358School Tax Rate - LOCAL1332School Tax Rate - STATE173County Tax Rate079TOTAL1942 2020 Town Tax Rate335 School Tax Rate - LOCAL1291 School Tax Rate - STATE170 County Tax Rate080TOTAL1876Median Ratio 1002 2019Town Tax Rate449School Tax Rate - LOCAL1479Scho.

NH DEPARTMENT OF REVENUE ADMINISTRATION. Pin On Beach Life Pin On No Place Like Home America S 15 States With Lowest Property Tax Rates House Prices Louisiana Homes Property Mapsontheweb Infographic Map Map Sales Tax. We are working hard at giving you the real time quotes for every county and lender.

Tax Rates General Information. 284 -003 Local School Rate. New Hampshire Property Tax Rates.

Hudsons share of the county tax burden for 2005 was approx. Alphabetical Order by Municipality. All documents have been saved in Portable Document Format.

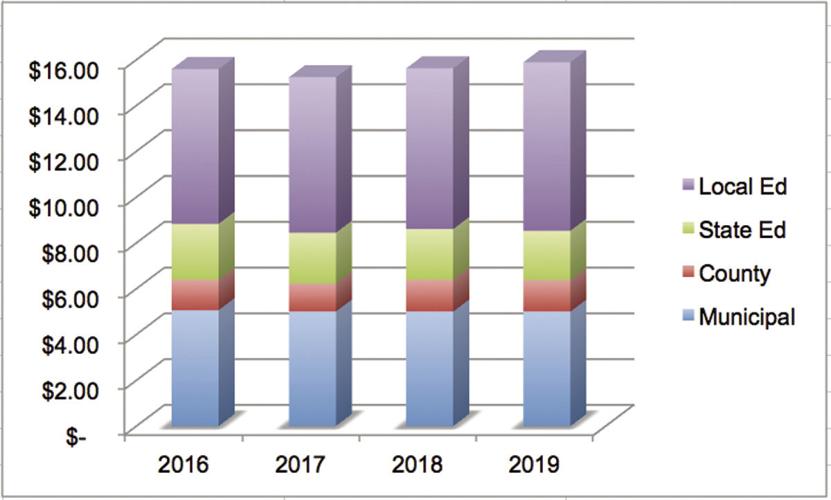

The breakdown below represents what contributes to the tax rate. Ad View County Assessor Records Online to Find the Property Taxes on Any Address. Tap or click any marker on the map below for more information From Concord to Keene to Rye to Jackson to Nashua.

State of New Hampshire and the Towns of Hampton North Hampton Rye Seabrook and New Castle to operate seacoast beaches during the COVID-19 pandemic. MUNICIPAL AND PROPERTY DIVISION 2019 Tax Rate Comparison. Valuation Municipal County State Ed.

Statistical Reports - Each file contains 2 or 3 Lists Alpha and County or Alpha County and. Form PA-28 Inventory of Taxable Property. 236 rows town total 2020 tax rate change from 2019.

Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2019 Municipality Date Valuation w Utils Total Commitment 1 200000 200000 000 000 000 Campton 112219 433123236 11137603 Canaan 102319 344646906 11289001 Cambridge U 112119 9092072. City of Dover Property Tax Calendar - Tax Year April 1 through March 31. See also the City of Manchester Finance Department for a look at historical property tax rates.

The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. - Fri 830AM - 430PM. No Inventory List of Towns NOT Using the PA-28.

240 rows In New Hampshire the real estate tax levied on a property is calculated by multiplying the. 088 001 total rate. Uncategorized nh property tax rates by town 2019.

The 2021 tax rate is 1768 per 100000 of assessed valuation. The exact property tax levied depends on the county in new hampshire the property is located in. Town Rate 269.

Alphabetical Order by Municipality.

These Are The Best And Worst States For Taxes In 2019

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

An Overwhelming Majority Of Homeowners Would Take Advantage Of The Mortgage Interest Deduction And State And Real Estate Marketing Homeowner Mortgage Interest

Property Taxes By State County Lowest Property Taxes In The Us Mapped

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

8 Signs It S Finally Time To Hire A Pro To Do Your Taxes Don T Wait Toot Is To Late Get Expert Advice B D Tax A Diy Taxes Real Estate Tips Types

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

Tax Burden By State 2022 State And Local Taxes Tax Foundation

States With Highest And Lowest Sales Tax Rates

Wondering How Much You Should Put Towards A Downpayment Overwhelmed With About A Hundred Other Questions Relate In 2022 Buying Your First Home House Hunting Homeowner

Meredith Tax Rate Rises 1 7 Percent Local News Laconiadailysun Com

Tuition And Fees Over Time Trends In Higher Education The College Board Tuition Native American Spirituality College Board

Are Social Security Benefits Taxable You Better Believe It Uncle Sam Can Tax Up To 85 Of Your M Social Security Benefits Social Security Retirement Benefits

![]()

Why Is A Mortgage Calculated Based On Gross Income In 2022 Mortgage Mortgage Loans Income