what does it mean to be tax deferred

What does it mean when tax is deferred. What Does Tax Deferred Mean.

Deferred Income Tax Definition Example How To Calculate

For example if you purchase a property for 300000 and five.

. Tax deferred simply means that you are allowed to postpone paying taxes on an asset such as an investment until a later date. Retirement accounts are setup to hold these funds and let them grow. When it comes to retirement accounts tax-deferred accounts are mentioned a lot.

The term deferred tax refers to a tax which shall either be paid in future or has already been settled in advance. A tax-deferred savings plan is a savings plan or account that is registered with the government and provides deferral of tax obligations. It is important to note that tax deferred is not the same as tax exempt which refers to the absence of applicable taxes.

Why Does Tax Deferred Matter. Tax deferral is when taxpayers delay paying taxes to some point in the future. Tax deferral means not paying federal income tax now but in the future when you take withdrawals from your retirement savings account like a 401k IRA or annuity.

A deferred tax liability occurs when a business has a certain amount of income for an accounting period and that amount is different from the taxable amount on their tax return. A deferred income tax is a liability recorded on the balance sheet that results from a difference in income recognition between tax laws and accounting. Some taxes can be deferred indefinitely while others.

DEFINITION of Tax DeferredTaxdeferred status refers to investment earnings such as interest dividends or. What does tax deferred mean. Deferred tax DT refers to the difference between tax amount arrived at from the book profits recorded by a company and the taxable income.

The two main types of tax-deferred benefits for American taxpayers are some annuities and some retirement accounts. Tax deferral is a tax-strategy that pushes out the due date on taxes for gains on an investment. Knowing what tax-deferred means will help you decide if these accounts are.

Tax deferral is an incentive the government provides to encourage people to save for their own retirement. Tax deferred means that the tax that a person or company will need to pay on investments revenues or profits will be deferred to a future point. In this article we will see why a company may differ its tax to.

What Does Tax-Deferred Mean. Deferred Income Tax. Deferred Tax Liability.

What Does Tax Deferred Mean It goes without saying that nobody is a fan of paying taxes and if given a choice most people would hold off forking over the money for as long as humanly. A deferred tax liability is an account on a companys balance sheet that is a result of temporary differences between the companys accounting and tax. An annuity is an investment vehicle that combines.

When a taxpayer is said to have deferred their taxes what it means is that they have put off the payment of their taxes until a later date in the future where it may be either. From commuter and childcare benefits to retirement accounts pre-tax benefits and tax-advantaged accounts offer some sort of tax benefit whether that means contributions. The effect arises when taxes are either not.

What Does Tax Deferred Mean. This can be beneficial because it allows you to. Tax-Deferred Savings Plan.

Employee Social Security Tax Deferral Repayment Process

What Tax Deferred Annuities Are And How They Work

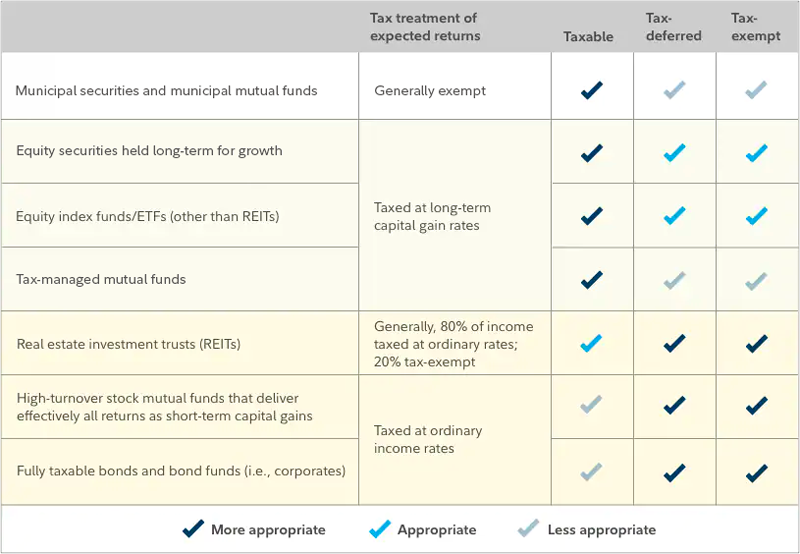

Asset Location Investing In The Right Accounts Fidelity

What Does Tax Efficient Investing Actually Mean Halpern Financial

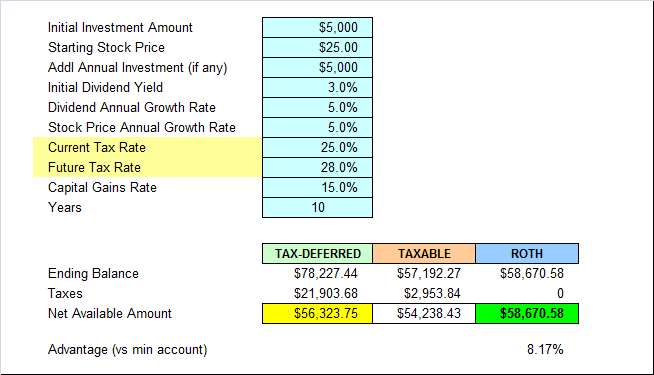

Do Tax Deferred Investments Save You Money Simplywise

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

Deferred Tax Asset Journal Entry How To Recognize

What Does Tax Deferred Retirement Savings Mean My Digital Money

The Hierarchy Of Tax Preferenced Savings Vehicles

The Tax Benefits Of Your 401 K Plan Turbotax Tax Tips Videos

What Does Tax Deferral On Esops Mean For A Startup Trica Equity Blog

What Is Tax Deferred Growth The Motley Fool

What Does The Payroll Tax Deferral Mean For Self Employed People Legalzoom

Tax Deferral How Do Tax Deferred Products Work

Taxes Pay 15 Now Or 25 Later Seeking Alpha

Top Tax Deferral Strategies Pure Financial Advisors

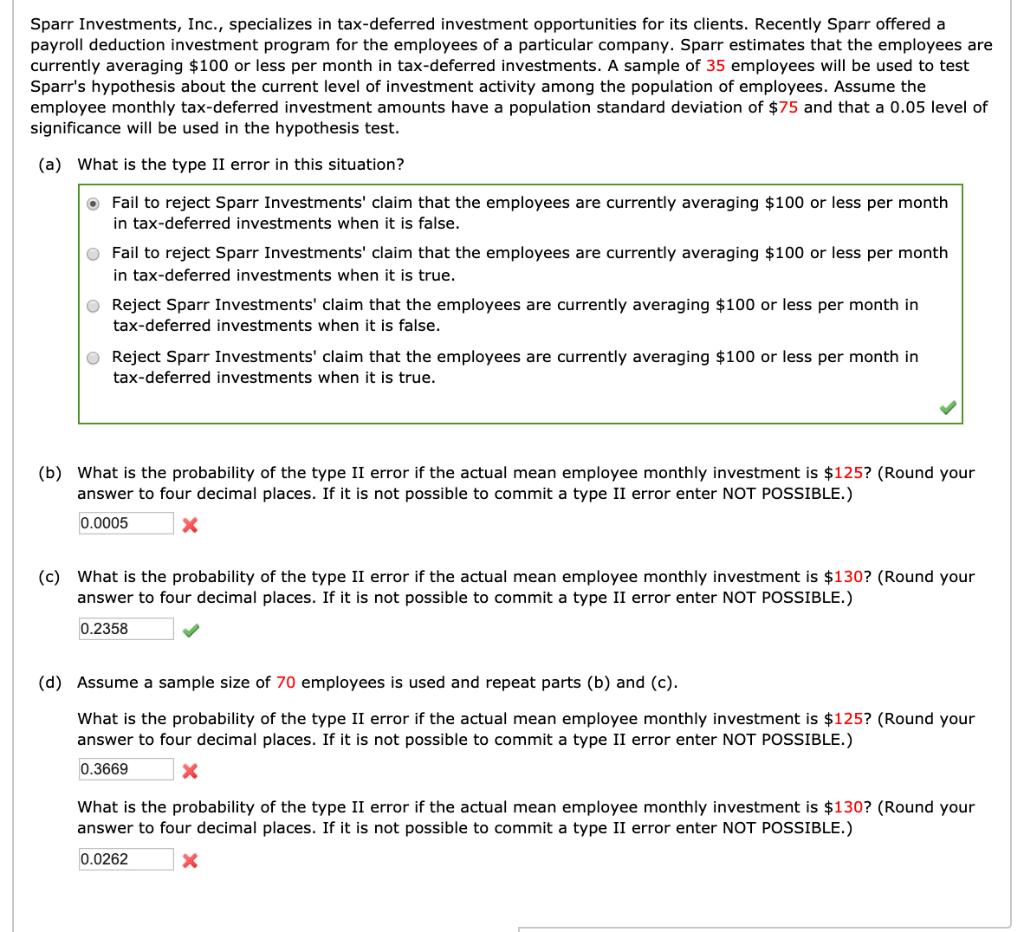

Solved Sparr Investments Inc Specializes In Tax Deferred Chegg Com

Tax Deferred Vs Tax Free Investment Accounts David Waldrop Cfp